RBI’s Forward Guidance focuses on growth, acknowledging risks

In a bold move to support growth, the RBI slashed the repo rate by 50 bps, signalling confidence amid easing inflation while cautioning against global and weather-related risks.

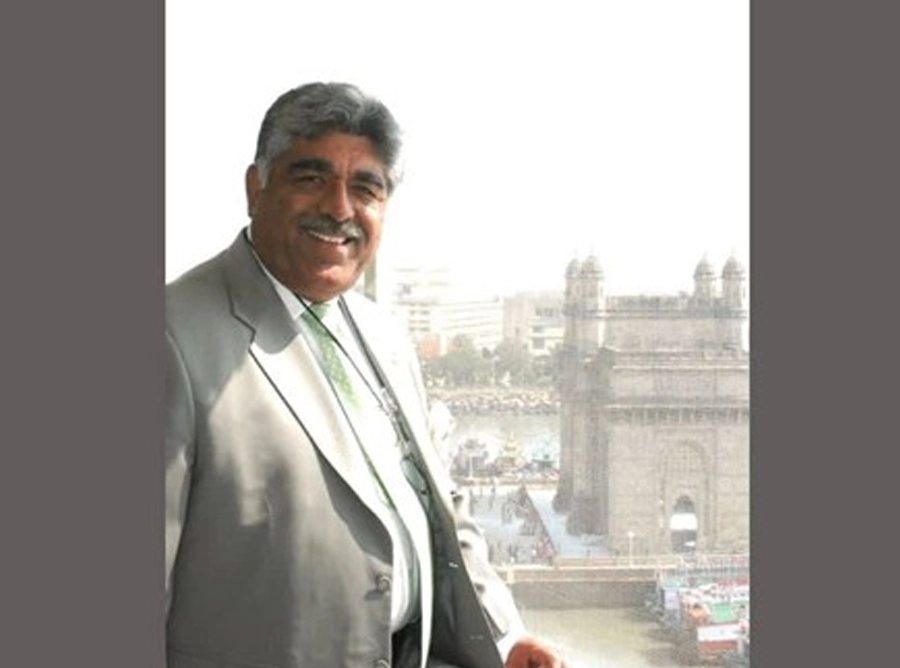

Vipin Malik, Chairman & Mentor, Infomerics Ratings

RBI has frontloaded a jumbo 50 bps reduction in the repo rate in the June’25 monetary policy taking the most opportune time when the CPI inflation is at lowest. CPI headline inflation softened by a cumulative 45 basis points during March-April 2025, from 3.6 per cent in Feb’25 to a low of 3.2 per cent in April 2025; the lowest reading since July 2019.

Due to piquant correction in

vegetable prices, food inflation reduced to a 42-month low of 2.1 per cent in

April from 3.8 per cent in Feb’25. Fuel group has increased to 2.9 per cent in

April 2025. CPI excluding food and fuel inflation have increased to 4.2 per

cent (YOY) in April 2025.

Gold, which has a share of 2.3 per

cent within CPI excluding food and fuel, contributed 21.4 per cent to the core

inflation in April 2025. Going forward, the likely above normal monsoon along

with its early onset augurs well for Kharif crop prospects. Hence, inflation

expectations are showing a moderating trend.

Despite such favourable trends, RBI

has flagged the following risks:

· Weather-related

uncertainties.

· Possible

transmission of tariff related concerns towards global commodity prices.

· Potential upward thrusts on core inflation due to upward gold prices (this risk though not flagged directly by RBI; this must be considered due to increasing gold preferences amid global uncertainties).

Taking

note of the abovementioned factors and assuming a normal monsoon, CPI inflation

for the financial year 2025-26 is now projected at 3.7 per cent, with the

following quarterly projections:

· Q1

at 2.9 per cent.

· Q2

at 3.4 per cent.

· Q3

at 3.9 per cent.

· Q4

at 4.4 per cent.

The inflation projections have been slightly enhanced for Q3 (3.9 per cent) compared to the previous policy projections for the third quarter at 3.8 per cent. However, overall projection for 2025-26 remains favourable at 3.7 per cent in June’25 policy compared to the 4 per cent projection at the previous Apr’25 policy. In the Apr’25 policy, CPI inflation for the financial year 2025-26 was projected at 4.0 per cent, with Q1 at 3.6 per cent; Q2 at 3.9 per cent; Q3 at 3.8 per cent; and Q4 at 4.4 per cent.

In order to support banks in reducing

cost of funds and providing them with more liquid funds, The RBI decided to

reduce the cash reserve ratio (CRR) by 100 basis points (bps) to 3.0 per cent

of net demand and time liabilities (NDTL), which will be carried out in four equal

tranches of 25 bps each with effect from the fortnights beginning September 6,

October 4, November 1 and November 29, 2025. The cut in CRR would release

primary liquidity of about ₹2.5 lakh crore to the banking system by December

2025. In addition to provide durable liquidity, it will also reduce the cost of

funding of the banks.

The RBI has also changed the policy

stance towards neutral from accommodative clarifying that the space for growth

has become limited after a cumulative 100 bps reduction in the policy repo

rate.

The inflation outlook for the year is

being revised downwards from the earlier forecast of 4.0 per cent to 3.7 per

cent. The economic growth remains lower amidst challenging global situation and

heightened uncertainty. According to the provisional estimates released by the

National Statistical Office (NSO) on 30th May 2025, real GDP growth

in Q4:2024-25 has been positioned at 7.4 per cent as against 6.4 per cent in

Q3. On the supply side, real gross value added (GVA) increased by 6.8 per cent

in Q4:2024-25. For 2024-25, real GDP growth was placed at 6.5 per cent, while

real GVA recorded a growth of 6.4 per cent.

Agriculture prospects remain bright

on the back of an above normal southwest monsoon forecast and resilient allied

activities. Services sector is expected to maintain its momentum. However,

spillovers emanating from protracted geopolitical tensions, and global trade

and weather-related uncertainties pose downside risks to growth.

The jumbo rate cut may be justified

at this policy in the sense that going forward, such conducive environment may

not be available with potential risks like weather related uncertainties,

possible transmission of tariff related concerns towards commodity prices,

potential upward thrusts on core inflation due to upward gold prices, any

further geopolitical challenges may push up global commodity prices and distort

the supply chains. Hence, the policy decision can be explained largely from the

point of view of taking maximum advantage of the opportune time.